IRS W-7 Form Instructions

IRS Form W-7 in PDF With Instructions

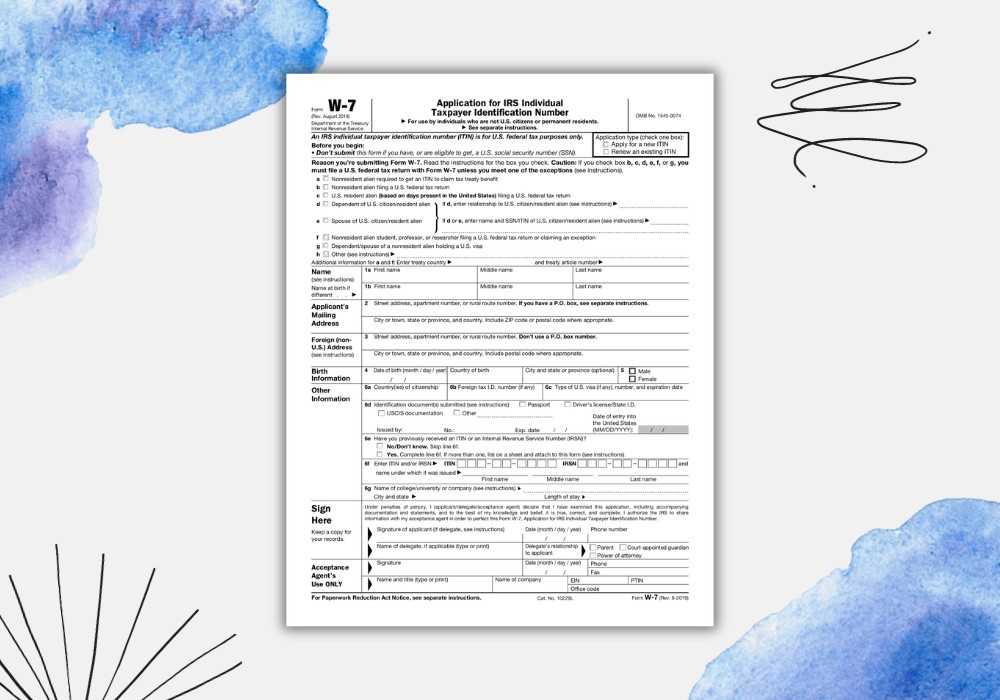

Get FormDealing with taxes can be complicated, especially for non-residents and immigrants who aren't familiar with the Internal Revenue Service (IRS) requirements. One document you might have encountered is the W-7 form. This leads us to questions about the instructions for Form W-7: who uses this application, and under what circumstances? Form W-7 is designed for those applying for an Individual Taxpayer Identification Number (ITIN). The IRS uses the ITIN to process taxes for those who do not have and are not eligible to obtain a Social Security Number.

Form W-7 & Pivotal Aspects to Consider

The application may seem daunting due to its legal and financial technicalities, which is why understanding the essential aspects of the IRS W-7 form instructions can be handy. Here are some key points to consider:

- The form must be filled in English.

- Personal details should match the ones provided on tax returns.

- Supporting documentation, such as tax returns, must be attached when submitting Form W-7.

- Ensure you select a suitable reason for applying for an ITIN from the outlined options.

ITIN Application W-7: Common Mistakes & How to Avoid Them

As with any legal document, filling out Form W-7 correctly is crucial, or you risk delaying your application. However, many people make fundamental errors due to their unfamiliarity with the W7 instructions in PDF format provided by the IRS on their official website. One common mistake is not correctly entering their details. For example, names not matching exactly with those on tax documents can lead to setbacks. It is imperative to be meticulous when entering information and cross-check everything before submitting.

Another common error is choosing the wrong reason for applying for an ITIN. This can be avoided by carefully reading the Form W-7 instructions and choosing the most suitable reason from the options provided. Lastly, always remember to attach the necessary supporting documentation specified by the IRS, such as tax returns or passports.

Alternatives to Form W-7

If you're wondering whether there are alternative ways to pay taxes without the ITIN, rest assured. If you already have a Social Security Number, you generally would not need to apply for an ITIN, and hence, you wouldn’t need to fill out the W-7 form. The IRS uses Social Security Numbers to process personal income taxes and assures compliance with tax laws. If you do not have a Social Security Number, another alternative worth considering is applying for one through the Social Security Administration (SSA).

However, knowing the W7 tax form instructions is pivotal for those who cannot obtain a Social Security Number or those who fall under specific categories as specified by the IRS. By being aware of these instructions, they can overcome common errors and navigate the tax landscape in the US more readily.