Printable W-7 Form

IRS Form W-7 in PDF With Instructions

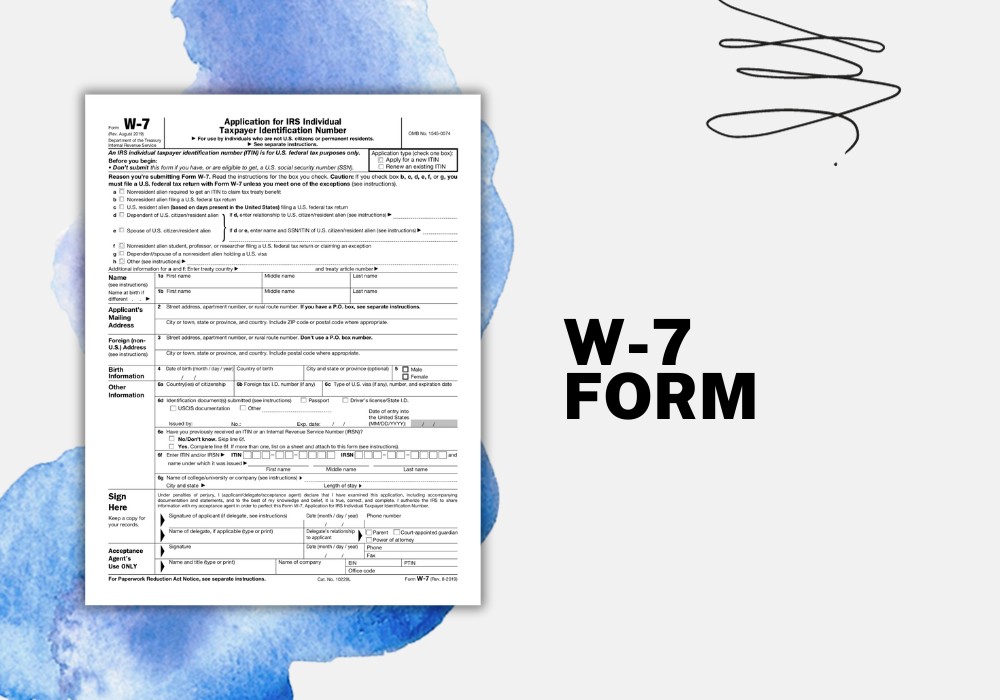

Get FormThis section will describe the specifics and structure of an IRS W-7 form printable template. The IRS Form W-7, also known as the Application for IRS Individual Taxpayer Identification Number (ITIN), has several important sections necessary for completion. It includes personal information such as name, mailing address, and birth details and also requires specific documents for identity verification. Let's discuss this form in more detail.

The W-7 Printable Form: Step-By-Step Completing Guide

Appropriate processing of the W7 form for print involves carefully filling out its parts. Here is a simplified guide to help you.

- Part 1 requires basic personal information such as your legal name, date of birth, country of citizenship, sex, and current address.

- Part 2 includes the detailed purpose behind applying for an ITIN, where you have to tick the appropriate box that best fits your situation.

- Part 3 focuses on information about your passport or two other documents proving your identification.

- Parts 4, 5, and 6 include some signature lines and declarations, which have to be duly signed.

Filing the W-7 Application to the IRS

Once you have completed the W-7 printable form, you must send it along with your tax return, proof of identity, and foreign status documents to the IRS. This has to be mailed to the IRS address stated on Form W-7 instructions. Be sure to retain a copy of all the documents and the filled form for your records.

Important Deadlines for IRS Form W-7

Time limits to file your IRS Form W-7 for 2023 printable depend on particular tax-related circumstances. If you're filing your tax return with your ITIN application (Form W-7), you'll typically need to apply by the tax filing due date, typically April 15th. However, if you're filing the W-7 form due to income subject to withholding, you ought to submit it within the calendar year’s conclusion in which the income was received. Beyond these situations, the form can be submitted anytime during the year.

Printable W-7 Form: Key Takeaways

It’s crucial to remember some tips while filling out the printable W-7 form in 2023.

- Any errors can cause a delay or rejection of your application.

- The primary rule is to use black ink to complete the template, as it's more legible than other colors.

- Do not use PO Box addresses; use your physical address instead.

- Ensure to double-check the data you've entered, especially the numbers, to avoid any factual errors.

- Lastly, remember to sign the form wherever necessary.

Understanding the IRS Form W-7, how to complete it, and when to file it can make this tedious task feel like a breeze. Here’s hoping this guide serves well for your financial management journey!